FOREIGN TRADE ZONE

WHAT IS A FOREIGN-TRADE ZONE?

![]()

- Created by the U.S. Foreign-Trade Zone Act of 1934

- New Deal legislation

- Maintain and Create U.S. jobs and investment

FOREIGN TRADE ZONE #294

ADVANTAGES

![]()

- Zone to Zone transfer (in-bond) of merchandise is duty deferral

- Duty deferrals, Duty reductions (inverted tariff), Duty elimination

- Delays in Customs duty drawback are eliminated

- Eliminates certain quotes and visa issues

- Duties are not paid on materials subject to defect, damage, and waste

- Duties are not incurred on labor, overhead, or profit attributed to FTZ production operations

- No time constraints on storage

- Reduced transit time

- Weekly entries and exports

- Tax reductions (not subjected to state and local ad valorem taxes while in an FTZ)

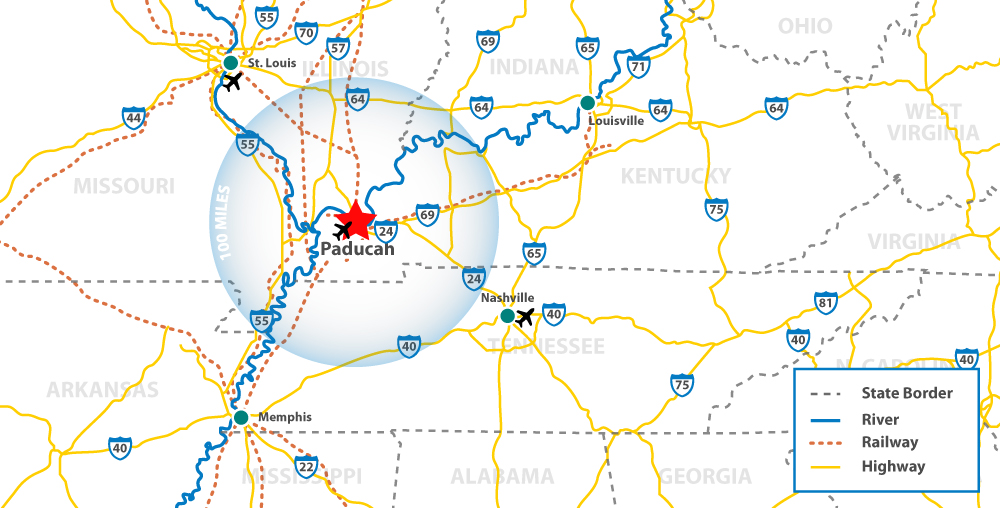

WE ARE POSITIONED TO BENEFIT FROM

THE FOREIGN TRADE ZONE #294

![]()

- Shovel ready land (approximately 3,900 acres based on thinkkentucky.com)

- Non-shovel ready land (approximately 2,206 acres based on thinkkentucky.com)

- Electric Power – Paducah Power / Jackson Purchase Energy have excess capacity

- Atmos Energy – Gas power can be made available

- Infrastructure – Interstate connection in all directions, Riverport, rail service (2 class 1 from NOLA), and available Air runway capacity

- WKCTC specialized workforce training programs / Murray State / UK Engineering

- Top 10% K-12 education and highly rated 2nd and 4th best Kentucky counties to live in

- Located in the center of the U.S. population

- One-day driving distance to 65% of the U.S population

FOREIGN TRADE ZONE

![]()

USER BENEFITS

USER BENEFITS

Merchandise imported into a Foreign-Trade Zone is considered to be outside the customs territory of the United States. Customs duty is deferred until the goods are removed from the FTZ. 411 Hackensack Ave Suite 806

Zone users pay lower duty rates on goods produced in the zone when the finished product has a lower duty rate than the imported components and parts.

Zone users will benefit by filing multiple Customs and Border Protection entries each week, consolidating multiple shipments to one processing fee payment.

Reduces duty payment on import waste and scrap of imported goods during the manufacturing process in the FTZ.

FTZ’s may transfer zone merchandise to other zone facilities without the payment of customs duties.

Goods imported and stored in a FTZ may be exported without ever incurring customs duties, avoiding lengthy drawback procedures.

USEFUL FEDERAL LINKS

U.S. Customs and Border Protection: https://www.cbp.gov/

U.S. Department of Commerce: https://www.commerce.gov/

HELPFUL RESOURCES

The National Association of Foreign-Trade Zones, an association of public and private members, is the collective voice of the Foreign-Trade program. The NAFTZ is the principal educator and the leader of demonstrating the FTZ program’s value and role in the changing environment of international trade.

http://www.naftz.org/

Foreign-Trade Zone Resource Center

The Foreign-Trade Zone Resource Center is a site that was designed to provide information to virtually anyone involved in the Foreign-Trade Zone (FTZ) program.

http://foreign-trade-zone.com/

Paducah Economic Development

Greater Paducah Economic Development (GPED) is an economic development alliance whose mission is to serve as the catalyst for wealth creation in the McCracken County region of Western Kentucky. GPED will accomplish this by pursuing an aggressive agenda of business development — marketing the region — and product development — improving regional business conditions through policy, workforce, and research initiatives.

http://epaducah.com/

Greater Paducah Chamber of Commerce

Kentucky Economic Development is responsible for strengthening the state’s business environment and creating a more vibrant Kentucky economy.

http://www.paducahchamber.org/

Purchase Area Development District

Kentucky Economic Development is responsible for strengthening the state’s business environment and creating a more vibrant Kentucky economy.

http://www.purchaseadd.org/

Kentucky Economic Development

Kentucky Economic Development is responsible for strengthening the state’s business environment and creating a more vibrant Kentucky economy.

http://www.thinkkentucky.com/

World Trade Center Kentucky

Kentucky Economic Development is responsible for strengthening the state’s business environment and creating a more vibrant Kentucky economy.

http://www.wtcky.org/

Small Business Administration

The SBA’s Office of International Trade’s mission is to enhance the ability of small businesses to compete in the global marketplace.

https://www.sba.gov/

GET IN TOUCH

2000 Wayne Sullivan Dr.

P.O. Box 2302

Paducah, KY 42002-2302

(270) 442-9326

HOME | ABOUT | FACILITIES | CONTAINER ON BARGE | FOREIGN TRADE ZONE | ECONOMIC DEVELOPMENT | RESOURCES | CONTACT

© Copyright 2019 Paducah-McCracken County Riverport Authority, All rights reserved.